In the vast realm of financial markets, position trading stands out as a strategy favored by many seasoned investors. Positioned between day trading’s rapid pace and long-term investing’s patient approach, position trading involves holding onto a position for an extended period, typically ranging from weeks to months. While potentially lucrative, this trading style carries its own set of risks that every trader should be keenly aware of. In this comprehensive guide, we delve into the risks associated with position trading and how to navigate them effectively.

Position trading revolves around identifying and capitalizing on long-term trends in the market. Unlike day trading, which involves executing multiple trades within a single day, or swing trading, which spans a few days to a couple of weeks, position traders aim to capture larger market moves over a more extended period.

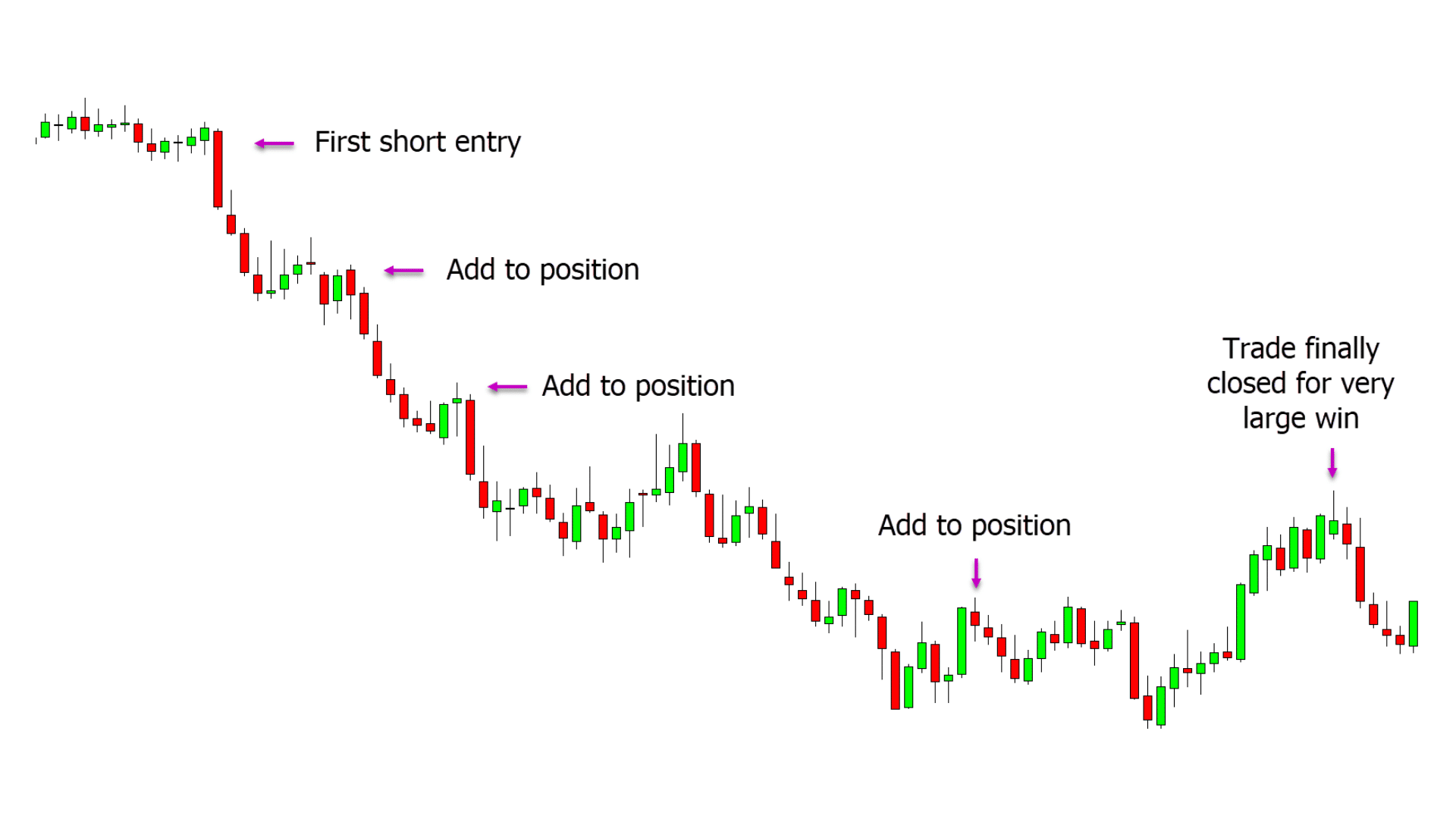

The core principle of position trading is to enter a position in an asset based on thorough analysis of fundamental and technical factors, then hold onto it until the trend reaches its peak, maximizing profit potential. This strategy requires patience, discipline, and a comprehensive understanding of market dynamics.

One of the primary risks in position trading is market volatility. Markets can experience sudden and significant price fluctuations due to various factors such as economic releases, geopolitical events, or unexpected news. These fluctuations can lead to increased risk exposure, potentially resulting in substantial losses if not managed properly.

Timing is crucial in position trading. Entering a position too early or too late can significantly impact its profitability. Traders must accurately identify the optimal entry and exit points based on their analysis of market trends and indicators. Failure to do so can result in missed opportunities or losses if the trend reverses unexpectedly.

Position traders often use leverage to amplify their trading capital, allowing them to control larger positions with a smaller initial investment. While leverage can magnify profits, it also amplifies losses, increasing the risk of margin calls and potential account liquidation if trades move against the trader. Managing leverage and margin effectively is crucial to mitigate this risk.

Liquidity refers to the ease with which an asset can be bought or sold without causing significant price movements. Illiquid markets pose a risk to position traders, as it may be challenging to enter or exit positions at desired prices, especially when dealing with large positions. Traders should be cautious when trading illiquid assets to avoid slippage and unfavorable execution prices.

Position traders hold their positions overnight, exposing them to overnight risk. Market conditions can change dramatically overnight due to after-hours trading, news releases, or geopolitical events, leading to gaps in price when the market opens. These gaps can result in significant losses if the trader’s position is on the wrong side of the move.

Trading psychology plays a crucial role in position trading. Emotions such as fear, greed, and overconfidence can cloud judgment and lead to impulsive decisions. Traders must maintain discipline and emotional control to stick to their trading plan and avoid making rash decisions based on market fluctuations or short-term trends.

Implementing robust risk management strategies is essential for mitigating risks in position trading. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to spread risk across different assets, and allocating only a small portion of your trading capital to each position.

Conducting thorough analysis before entering a position is crucial for success in position trading. This includes both fundamental analysis, which evaluates the intrinsic value of an asset based on economic and financial factors, and technical analysis, which examines past price movements and chart patterns to identify potential trends and entry points.

Stay updated on market developments, economic indicators, and geopolitical events that could impact your positions. Being aware of potential catalysts and risks allows you to adjust your trading strategy accordingly and minimize unexpected losses.

Position trading requires patience and discipline. Avoid the temptation to chase short-term gains or deviate from your trading plan based on emotions or market noise. Stick to your strategy and trust your analysis, even during periods of market turbulence.

The financial markets are constantly evolving, and successful position traders adapt to changing conditions by continuously learning and refining their trading strategies. Stay informed about new trading techniques, market trends, and risk management practices to stay ahead of the curve.

Take advantage of trading platforms and tools that offer advanced charting capabilities, real-time market data, and risk management features. These tools can help you make informed trading decisions and execute trades more efficiently, reducing the risk of human error.

Join us and enhance your skills! Explore our wide range of courses and take your knowledge to the next level.

Position trading offers the potential for significant profits by capitalizing on long-term market trends. However, it also carries inherent risks that traders must be aware of and actively manage. By understanding the risks involved, implementing robust risk management strategies, and staying disciplined in their approach, position traders can navigate the complexities of the market and increase their chances of success in the long run. Remember, patience, perseverance, and continuous learning are the keys to thriving in the world of position trading.

WhatsApp us